Excel Bookkeeping Templates

Choose your package and purchase securely via Stripe.

Included in every template Mostly automated

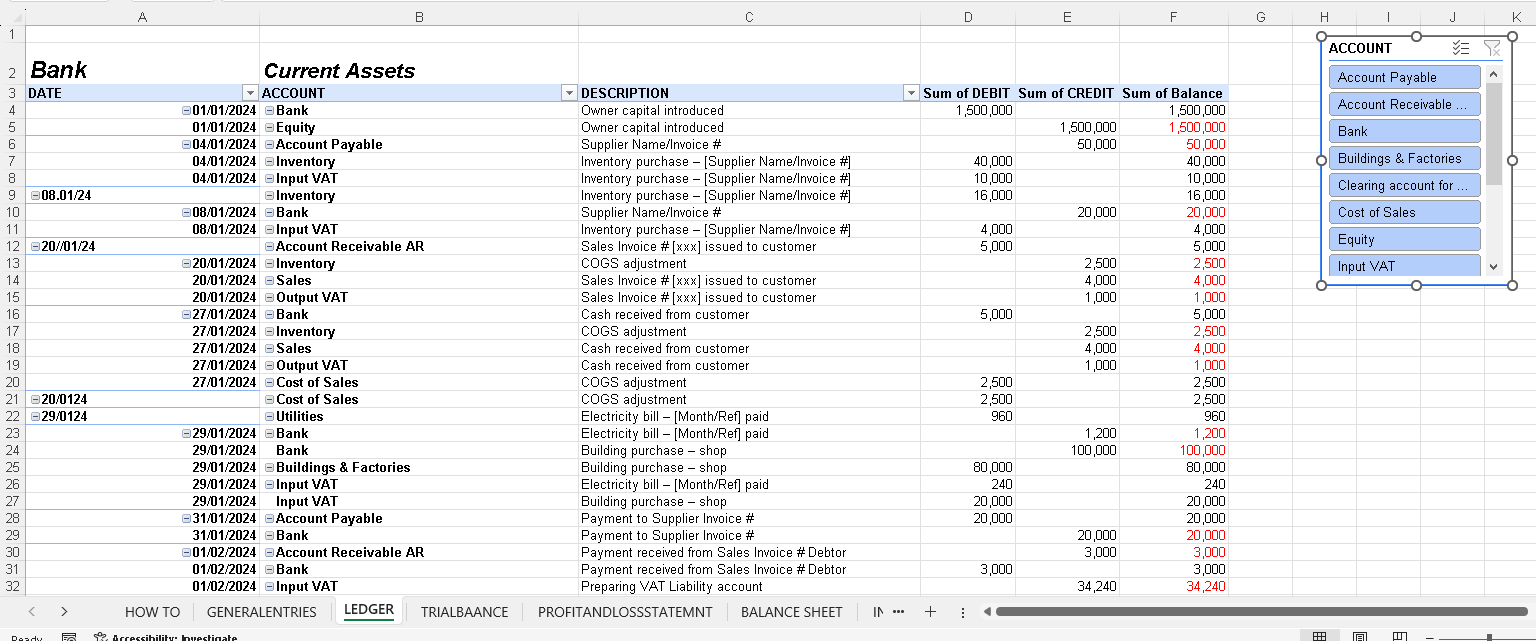

- General Ledger & Chart of Accounts

- Automated Trial Balance

- Automated VAT accounts

- Products/Services List, Suppliers List, Customers List

- Automated custom invoice with discount calculations

- Invoice Payment Tracker

- Inventory Tracker

- Employee Tracker & wages calculation with automated NIC tax

- Self Assessment Tax Calculator

- Profit & Loss Statement and Balance Sheet

- User Guide / How-to instructions

Ledger. Trial balance, P&L, Balance Sheet, Invoice, & Other sheets are autocalculated, and others with very little manual entries./p>

Requirements: Microsoft Excel 2016+ or Microsoft 365 (Windows or Mac). Not designed for Google Sheets or Apple Numbers.

VAT Registered Excel Bookkeeping Spreadsheets Business Edition

Full Setup

£149.00

Video Preview of VAT Registered Excel Bookkeeping Spreadsheets Business Edition

Video Preview of VAT Registered Excel Bookkeeping Spreadsheets Business Edition

- Double-entry bookkeeping with UK VAT: post every transaction in GENERALENTRIES; LEDGER & TRIAL BALANCE update automatically.

- VAT workflow: record Output/Input VAT, reconcile each quarter, then clear to VAT Liability and record payments/refunds to HMRC.

- Payroll (Timesheet → Payslip): EMPLOYEETIMESHEET rolls up weekly/monthly; A5 Payslip calculates PAYE (YTD method), Employee NI (PT/UEL), and fixed pension; YTD totals included.

- Sheets included: CONFIG (tax bands, NI thresholds, employees, pension), GENERALENTRIES, LEDGER, TRIAL BALANCE, P&L, BALANCE SHEET, optional MASTER INVENTORY / STOCKTRACKER / VARIANCETRACKER, SHORTTERM LIABILITIES.

- Protected/hidden logic: input cells are unlocked; formula columns are protected. System sheets (e.g., CHART OF ACCOUNTS) are hidden and pre-configured.

- RTI filing: Excel can’t submit FPS/EPS. Use HMRC Basic PAYE Tools or recognised software; copy period totals from the workbook.

- We set it up for you: COA & VAT accounts, opening balances, tax/NI thresholds, employees, payslip print preset.

- Handover call to walk through entries, VAT clearing, and reports.

Best for VAT-registered UK businesses that want clean double-entry with payroll and optional inventory.

Buy nowGuided Setup

£89.00

- Same double-entry + VAT template and payroll features as Full Setup.

- Follow the guide’s Before you start and Clearing sample data safely steps.

- Email guidance while you enter opening balances, VAT scheme, employees and pay periods.

- Reminder of protected columns and hidden system sheets.

Template Only

£59.00

- Complete workbook with GENERALENTRIES → LEDGER → TRIAL BALANCE flow and example P&L / Balance Sheet links.

- Payroll sheets (Timesheet & A5 Payslip) with PAYE/NI YTD logic included.

- Optional inventory pack and SHORTTERM LIABILITIES sheet ready to use.

- Comes with the full user guide, including VAT patterns and payslip print settings.

Hairdresser Excel Bookkeeping Spreadsheet

Full Setup

£119.00

Preview of Hairdresser Excel Bookkeeping Spreadsheet

Preview of Hairdresser Excel Bookkeeping Spreadsheet

- Designed for salons, barbers and mobile stylists.

- Service menu & stylist chair tracking (chair rent/commission).

- Tips & cash takings log with daily till reconciliation.

- Colour stock tracker (tubes/bowls) and retail product margins.

- Built-in invoice/receipt templates for retail and services.

- Full Setup: We load your stylists, services, prices and opening balances.

With Guided Setup

£69.00

- Same template as Full Setup with a setup checklist.

- Email guidance while you add services, stylists and stock.

Template Only

£49.00

- Ready-made ledgers for services, retail, tips and expenses.

- Monthly salon performance summary and stylist earnings.

Self Employed Excel Bookkeeping Template (UK Cash Basis Entries)

Premium Package

£59.00

- Cash-basis workflow: GENERALENTRIES → LEDGER → PNL. Enter all cash In/Out (dd/mm/yyyy); running bank balance and monthly P&L update automatically.

- Inventory & Reorders: Inventory with Method (Reorder Point or Min Max), Reorder? (TRUE/FALSE), target level, order multiple → auto ReorderList → printable PurchaseOrder.

- Sales & collections: printable Invoice (SKU pulls from PRICELIST) → track in INVOICE PAYMENTTRACKER (receivables/payables) and PAYMENTS RECEIVED/MADE (feeds cash totals).

- Payroll: EMPLOYEETIMESHEET (clearly marked ENTER vs AUTO columns) → A5 Payslip (Weekly/Monthly). Uses Config for tax bands, NI cat & tax code, TaxBasis (CUM/W1M1), and weekly/monthly pension amounts.

- Loans/HP: SHORTTERMLIABILITIES builds amortisation (PMT/Interest/Principal/VAT). Tick PAID? monthly and post the cash out in the Journal.

- Income Tax: quick annual estimate — enter Taxable Income only.

- Setup sheets included: Stock Tracker Settings (Cover Days, Lead Time, Safety, Order Multiple + address), Suppliers, PRICELIST, CHARTOFACCOUNTS, Config.

- Printing presets: Payslip A5 (2 per A4); Invoice/PO print areas ready; export to PDF.

- Premium extras: onboarding checklist + email guidance while you complete first-time setup (Config bands, employees, PRICELIST, Suppliers, Stock settings).

Standard Package

£49.00

- Same full workbook as Premium (cash-basis Journal → Ledger → P&L, Inventory/Reorder/PO, Invoice & Payment tracking, Timesheet → Payslip, Short-term Liabilities, Income Tax).

- Follow the built-in Quick start (5 minutes) steps and first-time setup notes in the user guide.

- All protected headers/helpers and print areas are pre-configured.

Template Only Package

£39.00

- Download-and-use workbook with the complete cash-basis toolset: GENERALENTRIES, LEDGER, PNL, Inventory, ReorderList, PurchaseOrder, Invoice, INVOICE PAYMENTTRACKER, PAYMENTS RECEIVED/MADE, EMPLOYEETIMESHEET, Payslip, SHORTTERMLIABILITIES, Income Tax.

- Includes the user guide with copy-ready formulas (e.g., Month helper, Inventory Reorder Qty) and tips/troubleshooting.

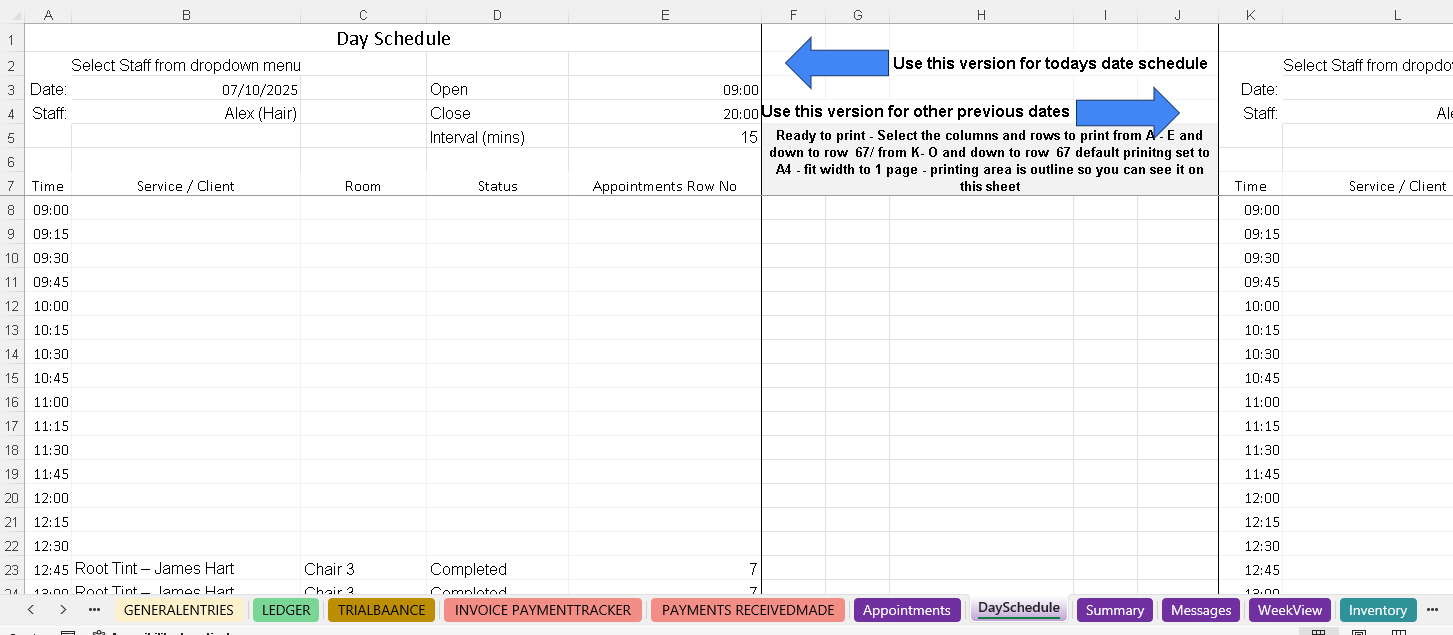

Salon Bookings Excel Template (Hair Beauty Nails Tanning)

Template Only

£25.00

- Weekly and daily calendar views with time blocks.

- Service duration, staff allocation and no-show tracker.

- Automatic daily totals and capacity utilisation.

- Works nicely alongside the Hairdresser Bookkeeping template.

Excel Employee Pay Spreadsheet Template UK PAYE

Template Only

£39.99

- What it does: Tracks hours → calculates Gross, PAYE, Employee NI, fixed Pension and Net pay; supports Weekly or Monthly pay with YTD totals. Produces a clean, print-ready A5 payslip. Works offline in Excel.

- Config (set once per tax year): enter tax bands/rates (

PersonalAllowance,BasicUpperTaxable,HigherUpperTaxable,BasicRate,HigherRate,AdditionalRate), NI thresholds/rates (NI_PT_Wk/Mth,NI_UEL_Wk/Mth,NI_MainRate,NI_UpperRate), employees (Name, NI No, NI Cat, Tax Code, Tax Basis CUM/W1M1) and your fixed weekly/monthly pension amounts. - EMPLOYEETIMESHEET (enter daily time): Enter: Employee • Date • Start/End time • Hourly rate • (optional) Deductions. Auto: Week No/Start, daily/weekly hours, weekly & monthly pay, PAYE, NI, pension. Note: period totals show only on the last row of the week/month per employee (blanks elsewhere are by design).

- Payslip (A5, print-ready): B4 Employee → D4 Weekly/Monthly → F4 pick Week start (Mon) or H4 pick Month (month-end date). Slip fills Gross, PAYE, Employee NI, Pension, other deductions (sum), Net, and YTD Gross/PAYE/NI.

- Printing: A5, Portrait, Fit to 1 page, Narrow margins. For two slips per A4: export to PDF → print “2 pages per sheet”.

- Important (RTI): Excel can’t submit RTI (FPS/EPS). File via HMRC Basic PAYE Tools (free) or HMRC-recognised payroll software.

- Scope: Weekly/Monthly pay, PAYE, Employee NI, fixed Pension, YTD totals, print-ready payslips.

- Not included: RTI submission, Employer NI, pension-provider upload files, auto-enrolment comms, multi-user concurrency.

Self employed delivery driver excel template - VAT registered/non VAT registered

Template Only

£49.99

- What it does: Records sales & purchases with VAT auto-calculated, builds monthly Ledger, P&L, and a ready-to-use VAT Return (Standard or Flat Rate).

- Config: Pick VAT scheme (Standard/Flat Rate), enter Flat Rate %, and edit VAT Codes. Dropdowns pull from your Clients, Suppliers, Fleet, and Drivers sheets.

- Multi-vehicle & drivers: Fleet sheet (tank size, MPG, depreciation per year) and Drivers sheet. Tag each journal entry to a Vehicle Reg and Driver ID; see per-vehicle/driver profit and fuel £/mile.

- Fuel & mileage: Log odometer, litres, and price per litre. Auto Avg MPG and Fuel cost/mile per selected vehicle and for all vehicles.

- Journal: Clean categories (Fuel, Repairs, Insurance, PlatformFees, DriverPay, etc.), VAT via code (STD/RED/ZRO/EXE/OOS). Client ID & Supplier ID are generated automatically from the name; you can use names from dropdowns.

- Invoice (special cases): Raise your own VAT invoice only when needed (direct B2B work, extras/surcharges, cross-charges to subcontractors). Otherwise post platform self-billing PDFs as Sales.

- Works offline in Excel: Microsoft Excel 2016+ or Microsoft 365 (Windows/Mac).

- Scope: VAT Standard or Flat Rate, per-vehicle & per-driver reporting, depreciation from Fleet, optional RateCard for your pricing, and PaymentTracker for receivables.

- Not included: HMRC submissions (VAT MTD/e-filing), bank feeds, payroll/RTI, multi-user concurrency, or automatic data imports.